This text is machine-read, and may contain errors. Check the original document to verify accuracy.

,f~"-'

..'

'

.

~

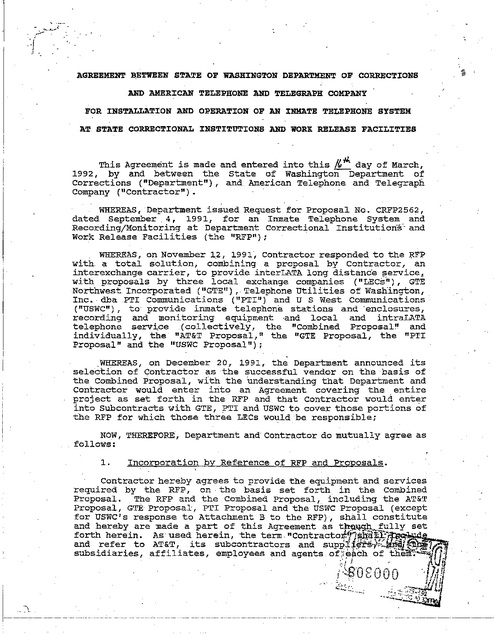

AGREEMENT

~ETWEEN

STATE OF WASHINGTON DEPARTMENT OF CORRECTIONS

AND AMERICAN TELEPHONE AND TELEGRAPH COMPANY

FOR INSTALLATION AND OPERATION OF AN INMATE TELEPHONE SYSTEM

AT. STATE CORRECTIONAL INSTITUTIONS AND WORK RELEASE FACILITIES

This Agreement is made and entered into this {{pitt. day of March,

1992, by and between the state of Washington Department of

Corrections ("Department"), and AInerican Telephone and Telegraph

Company (II Contractor") .

.

.

WHEREAS, Department issued Request for Proposal No. CRFP2562,

dated September 4, 1991, for an Inmate Telephone System and

Recording/Monitoring at Department Correctional Institution§~ and

Work Release Facilities (the "RFP");

WHEREAS,. on November 1.2, 1991', Contractor responded to the ~FP

with a total solution, combining a proposal by contractor, an

interexchange carrier, to provide interLATA long distance ~ervicet

with proposals by three local exchange companies ( "LEcs'II ) , GTE

Northwest Incorporated ("GTE"), Telephone utilities of Washington,

Inc •. dbaPTI communications (I'PTI") and U S west Communications',

("USWC"), to' provide inmate telephone stations and 'enclosures,

recording and monitoring equipment ,and local and intraLATA

telephone service (collectively, the "Combined Proposal~' and

individually, the "AT&T Proposal, II the "GTE Proposal, the "PTI

Proposal I' and the IIUSWC Proposal");

.WHEREAS , on December 20, 1991, the Department announced its

selection of Contractor as the successful vendor on the 'basis of'

the Combined Proposal, with the understanding that Dep~rtment and

Contractor would enter irito an Agreement covering the. entire

project as set forth in the RFP and that Contractor would ent~r

into Subcontracts with GTE, ?TI and USWC to cover those portions of

the RFP for which those three LECs would be responsible;

NOW, THEREFORE, Department and' Contractor do mutually agree as

follows:

1.

Incorporation by Reference of RFP and Proposals.

Contractor hereby agrees to provide the equipment and. services

required by the RFP, on· the basis set forth in the Combined

Proposal.

The RFP and the Combined Proposal, including the AT&T

Proposal, GTE Proposal, PTI Proposal and the USWC Proposal (except

for USWC's response to Attachment B to the RFP), shall constitute

and hereby are made a part of this Agreement as t~~~,".!21lly set

forth herein. As' used herein, the term,' IIcontracto:¢trl~a~l,~~,

.

.

and refer to AT&T, its subcontractors and supp.tf~~·f1.·:"!iI.~~lSTfr'fJ,

subsidiaries, affiliates, employees and agents, Of,Zii=jlCh of thei'fi:·;·...;.;r~rl'~.1

,

,

,:!J,

'''':8'0'0

,.

I . '. " ., '\.- L

' f)

'")0""

i ~:'-'.

v \,

l '

" "

.

' :::';. '. ,.

"""~

..

::\.

..:.__.;

Jh!j

"

'Ih,i.

J

Jj

... i /111'

',

, ...,.,.... <'I, t" I

~:.. ::: '.• :~:; .. !~ l-

•....~-.;~~

,." '.-., .'~1r.n.. j

'

�2.

.Scope of Agreement.

-

.

A.

The terms and 'conditions of this Agreement apply to the

LEC Public Telephones at Department Correctional Institutions and

Work Release Facilities listed on Attachment A to the RFP, as well,

as to new and expanded facilities for which the Department requests

servic~.

. B.

This Agreement; applies to two types ofLEC Public

Telephones:

Public Telephones made available to :I;nmates, from.

which only collect calls can be made ("Inmate PUblic Telephones ll )

and other Public Telephones located on the premises of certain

facilities for use by staff and visitors but not inmates (IIStaff

Public Telephones"), from which both "1+" and "0+" telephone calls

can be made. Unless otherwise stated in this Agreement, the term

"Public Telephone" shall refer both to Inmate Public Telephones and

Staff Public Telephones.

3.

Provision

Contractor.

of

InterLATA and

International

service

by

Contractor agrees to provide "0+" interLATA and international

service to all Public Telephones located on the premises of

Department Correctional Institutions and Work Release Facilities.

The ,Department hereby selects Contractor as the 110+ 11 primary

interexchange carrier (tlpIC") ,for operator assisted (110+) interLATA

and international calls placed from all 'such LEC Public Telephones.

The Department appoints Contractor-as its Agent for purposes of

submitting the Department's selection of Contractor as its PIC for,

such LEC Public Telephones. Nothing in this' Agreement requires the

Department to route "1.+" interLATA calls to AT&T from any

telephones covered by this Agreement.

4.

Subcontractors.

The Department hereby approves Contractor's'use of GTE, PTI

and USWC as Subcontractors under this Agreement. Set forth below

is a list of the equipment and services for which each of the

Subcontractors will be ,responsible to provide to the Department, in

accordance with the specifications of 'the RFP and the GTE Proposal,

PTI Proposal and USWC Proposal:

A.

GTE. GTE shall install and maintain public telephone

sets,

all

associated

equipment,

lines r

Dictaphone

recording/monitoring equipment and call ·timingand call blocking

software at the following loqation:

.

-

i.Washington State Reformatory, Monroe

GTE shall install and maintain pUblic telephone sets, .all

associated equipment r lines, call timing and blocking software at

the following loca~ions:

- 2 -

I~ ~11't''fl· 3'·

('\ "'".

.

".!;

~f

'C.l~,i;.)

.....

~.

�".· ''

ii. Twin Rivers Corrections Center

iii. Indian Ridge Corrections Cen~er, Arlington,

iv.

Special Offender

Cente~,

Monroe

GTE shall also provide local and intraLATA telephone service and

operator service to the GTE Public Telephones at the above four

locations.

B.

PTI. PTI shall install and maintain public telephone

sets,

all., associated

equipment,

lines,

Dictaphone

recording/monitoring equipment and call timing and call blocking

software at the following loc~tions:

i.

ii.

Clallam Bay Correotions Center

Washington Correction Center for Women

PTI shall install and maintain" public . telephone sets, ali

associated equipment, lines, call.timing and call blocking sof~~are

at the following locations:

.-.

iii. Olympic Corrections Center

iv.

v.

Pine Lodge Pre-Release

Coyote Ridge

PTI shall also provide local telephone service and operator service

to PTI Public Telephones at the above five locations.

C.

uswc. USWC shall install and maintain public telephone

sets,

all

associated

equipment,

lines,

.Dictaphone

recording/monitoring equipment and call timing and blocking

softwar~ at the· following locations:

i.

ii.

iii.

iv.

Washington Corrections center, Shelton

McNeil Island Penitentiary

Washington State Penit~ntiary, Walla Walla

Airway Heights

.

USWC shall install and maintain pUblic telephone sets,. all

associated equipment, lines, call timing and blocking software at

·the following locations:

.

v.

Tacoma Pre-Release

vi. Cedar Creek Corrections -Center

vii. Larch Corrections Center

USWC shall also provide local and intraLATA telephone service and

operator service to USWC Public Telephones at the above six

locations.

5.

Term.

The term of this Agreement shall be five (5) years, commencing

as of March 16, 1992 (l'Effective Daten) •. Upon at least sixty (60)

000310

�.

';",",

..

.. ,

"

days' written notice prior to the end of the initial term or a

r.enewal term-., either party may request renewal o'f the Agreement, in

which case the Agreement may be renewed for any length· of time

agreed upon by the parties. Upon expiration of the initial term or .

. a renewal term without either notice of termination or signing of

an agreement to renew, this Agreement shall automatically continue

on a month-to-month basis.

6.

Ownership of Equipment.

All equipment installed on Department premises pursuant to

this Agreement shall be provided as a service to the Department in

accordance with the RFP. No equipment shall be sold or leased to

the Department under this Agreement. Title to all public telephone

equipment,

monitoring/recording equipment,

software,

wiring,

hardware and enclosures installed pursuant to this Agreement shall

remain in contractor, or the applicable subcontractor or supplier,

during the term of this Agreement.

1.

Commissions Payable to the Department.

A.

In return for the right to provide Inmate and PUblic'

Telephone Service under this Agreement, Contractor, GTE, PTI and

USWC shall each pay to the Department on a monthly basis the

commissions set forth' in Attachment 1 to this Agreement.

Each

carrier's monthly commission checks shall be sent to ·the

Superintendent of each covered Correctional Institution or Work

Release Program, made. payable to the Inmate Welfare Fund, unless

and until the Department shall specify a dif.ferent payee for the

carriers' commission checks.

B.

For all

be payable as of

facilities in GTE

as of the cutover

.schedule mutually

Subcontractors.

facilities in USWC territory, commissions shall

the Effective Date of this Agreement.

For all

and PTI territory, commissions shall be payable

date established pursuant to the implementation

agreed upon by the Department, Contractor and its

.

C.

The commission schedule set forth in Attachment1,shall

also apply to LEC public telephones at. any new Department

Correctional Institutions or Work Release. Facilities which are

ad~edto this Agreement at the request of the Department.

D.

If any of the Commissions set forth in Attachment 1 are

.not paid within 45 days after' the end of any billing cycle,

interest at an annual rate of 10% shall be paid commencing as of

the 46th day.. 'l'his .interest charge shall not apply to the true-up

commission payments made by Contractor and DSWC with respect to the

initial billing cycles of this Agreement.

- 4 -

000311

�I

!

8.

Reports.

Contractor, GTE, PTI and USWC l?hall each provide the following

reports with respect to the traffic carried by that entity:

A.

A monthly call detail report for Inmate Public

Telephones, by institution, and addressed to the

superintendent of the institution showing the date, time,

payphone nUmber, called number and length o~each call.

B.

A monthly commission report for Inmate and Staff

Public Telephones, by institution, showing total revenues

generated by each Inmate and Staff Public Telephone for

that monthly comission cycle. Each such report shall be

sent to two locations: one copy to the institution and

one copy to the Department of corrections, Attention:

Sharon Shue, Telecommunications Manager, P.O. Box 4J;L10,

MS: 61, Olympia, WA 98504-41110.

,~.

9.

Maintenance

Contractor, its subcontractors and suppliers shall provide

maintenance for the equipment., software and services supplied under·

this Agreement pursuant to the terms and conditions of the RFP and

Proposals submitted in response to the RFP.

The appropriate LEC

(GTE, PTI or USWC) shall designate a single point of contact to

receive trouble reports for each Correctional Institution or Work

Release Program in that LEC I s territory.. The Department shall.

address trouble reports relating to any service or equipment

provided under this Agreement to these designated points of

contact, which are listed in Attachment· 2 to this Agreement.

Following the installation of equipment under this. Agreement,

.contractor, its subcontractors and· suppliers shall leave the

Department's premises in good-condition and broom clean.

10.

Responsibilities of the Department

The Department shall:

A.

Take reasonable precautions to protect the public

telephone' stations and related equipment and monitoring and

. recording equipment and software from damage, vandalism, theft or

. hazardqus conditions and promptly report any .damage,· service

failure or hazardous condition to Contractor I s points of contact as

-referred to in section 9 and listed in Attachment· 2to -this

Agreement ..

B. . SUbject to the Department's security requirements,

provide access, as needed to Contractor, its subcontractors,

suppliers and agents to service the equipment provided herein.

I

I

r--- . .

I

5 -

·0·.;j. . 1"'2·

i'~

00

�c.

Keep the pUblic telephone stations clean and the station

locations free from debris or obstructions.

11.' InterLATA "0+ Service

A.

staff Public Telephones shall comply with the signage and

unblocking requirement of the Telephone Operator Consumer Services

Improvement Act of i990.

B.

If' this. Agreement is amended to' add a Correctional

Institution or Work Release progr~m located in an area where

Contractor does not track billed "0+" interLATA revenues from LEC

Public Telephones, a monthly average revenue· (MAR) mutually ~greed

upon by the parties will be used in calculating Contractor's

monthly "0+" interLATA revenues. The developed MAR will be based

upon the monthly revenues generated from a like Washington state

.institution, with a similar inmate population and a similar ratio

of inmates to public telephones.

.

-:l::::

12.

~

.

Monitoring/Recording

Contractor shall provide live or mechanical

operator

announcements for all personal calls made from Inmate Public

Telephones that the call 'is coming from a prison inmate and that it

will be recorded and may be monitored and/or intercepted.

The

Department shall be responsible for in~tituting procedures at each

location to ensure that attorney-client calls are not recorded or

monitored.'

,

13.

Indemnification

A.

The Contractor shall defend, protect and hold harmless

the state of Washington, the Department, or any employees thereof,

from and against all claims, suits,' or actions arising from any

. negligent or deliberate act or omission of the Co:ptractor or

Subcontractor, or· agents' of either, while performing under the

terms .of this Agreement.

The provisions of this paragraph shall

not apply to any act or omission by the Contractor for which the

Department, in the text of this Agreement, has agreed to defend and

hold the Contractor harmless .. The provisions of this section sh~ll

su~ive any termination or the expiration of this Agreement.

B.

.The Department shall derend, protect and hold harmless

Contractor , its employees, agents or subcontractors, from and

against all claims', suits, actions, loss or injury arising from any

negligent or deliberate act or omission of the Department or any

employee thereof, while performing under the terms of this

Agreement, except to the extent that the claims result from the

negligence or willful acts of Contractor's employees, agents or

subcontractors.

The Department shall defend, protect and hold

-harmless the Contractor, its employees,agents or subcontractors,

from and against all claims/.suits, actions, loss or injury arising

out of or in any way connected with Contractor's provision of call

- 6 -

00031:f

�:.

'.

recording equipment and call monitoring equipment to the Department

under this Agreement. The provisions of this section shall survive

any termination or the expiration of this Agreement.

14.

Regulatory

. The local, intraLATA and interLATA service provided under this

Agreement is subject to applicable tariffs or price lists, as filed

pursuant to the requirements of the Federal communications

commission and the Washington Public Service commission.

15.

Force Majeure

Neither party shall be held liable for any delay or failure in

performance of any part of this Agreement caused by circumstances

beyond the reasonable control OI the party affected or its

subcontractors or suppliers, including, but not limited to, fire,

explosion, lightning ,pest damage, power surges or failures,

strikes or labor disputes, water, acts of God, the elements,'-war,

civil disturbances, acts of civil or" military authorities or"the

public enemy, inability to secure raw materials, transportation

facilities, fuel or energy shortages.

16.

Limitation of" Liability

Except in cases involving willful or wanton conduct,

Contractor J s liability to the Department wi th respect to·. the

provision of local, intraLATA or interLATA service shall be limited

to its obliga~ion to pay commissions as set .forth above.

Contractor's liability with respect to the provision· of public·

telephone stations and related equipment and the provision of

monitoring and recording equipment is limited to direct damages

which are proven. CONTRACTOR SHALL NOT BE LIABLE TO THE DEPARTMENT

FOR ANY INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE

LOSS OR DAMAGE OF ANY KINDT INCLUDING tOST PROFITS (WHETHER OR NOT

CONTRACTOR HAD BEEN ADVISED OF THE POSSIBILITY OF SUCH LOSS OR

DAMAGE), BY REASON OF ANY ACT OR OMISSION IN ITS PERFORMANCE UNDER

. THIS AGREEMENT.

17.

Conflict Resolution

"~'"

:

A.

Should a "dispute arise between the parties hereto, with

respect to the terms of this Agreement or the performance hereof,

the parties shall attempt to resolve the dispute informally, by

investigating and discussing the issues.

In working toward a

resolution of the dispute, the parties may seek the assistance of

upper management within the respective organ~zations of the

Department and the Contractor.

B.

In the event that informal efforts to resolve" a dispute

are unsuccessful, the parties shall, prior to filing suit, submit

their . dispute to a mutually agreed - upon third party mediation

service for non-binding mediation (for example, Judicial Mediation

- 7 -

�Service, 1420 Fifth Avenue, Suite 400, Seattle, WA 98101).

. ,party shall share the cost of such mediation.

18.

Each

Termination and Termination Procedure

A. In the event that a correctio~al facility)covered by this

Agreement is closed for lack'of funding, consolidation with other

facilities or as a result of other judicial or governmenta.l action,

the Department may terminate this Agreement as to that facility.

B. In the event of a failure by Contractor to perform any of

the provisions hereof with respect to anyone or more correctional

facilities covered by this Agreement, or with respect to anyone or

more of the three LEC territories covered by this Agreement (GTE,

PTI or USWC), the Department may give Contractor thirty (30) days'

written notice of intent to terminate for default, specifyinq.the

nature of the alleged failure of performance and identifyinq',the

locat.ton(s) and/or LEC territory affected. Contractor shall 'not be

deemed to be in default if Contractor cures the failure' of

performance within the thirty (30) day notice periOd, or' if the

'nature of Contractor's default is such that more than thirty (30)

days are reasonably required for its cure, then Contractor shall

not be deemed to be in default if Contractor shall commence such

cure within said thirty (30) day period and thereafter diligently

prosecute such cure to completion.

c.

Unless there is a default consisting of a fa:i,.i.ure of

performance as to the entire Agreement, '. a ·termination of this

Agreement under. the terms of this Section 18 a and b as to any

single correctional facility or as to any single LEC territory

shall not operate as a termination as to any other correctional

. facility or other LEe territory, and this Agreement shall remain in

full force and effect for all other correctional facilities and LEC

territories.

.'

D.

During the first three years of this' Agreement, the

Department may terminate this Agreement in whole or in part only

upon one or more of the following events:

1.

Termination for the reasons provided for in section

18 a., b~ and c. herein, or .

'

2.

Any' action bY' the legislature, the Governor's

office,. the Federal Communication Commission, the

Washington utilities and Transportation Commission

or a court of competent jurisdiction which results

in or necessitates termination of this Agreement in

whole or in part.,

Any termination under paragraph 18 D(,2) above requires at

least 90 calendar days' written notice of such action be

- 8 -

OQ03J5.

�provided to Contractor by Department as provided in

section 19 "Notices. II

#=

of

After the first three years

this Agreement, either

party may terminate this Agreement without cause by

giving written notice to the other' party, as provided for

herein, at least 180 calendar days prior to the e'ffective

date of said termination.

19.

Notices

A.

Any notices or other communications to be given under

this Agreement shall be. provided to the following parties by

personal delivery, first class u.s. mail or facsimile:

state of Washington

Department of Corrections

P.O. Box 9699, MS: FN-61

olympia, WA 98504 .

Attention: Gary L. Banning

Administrator, Contracts

and RegUlations

Facsimile no.

(206) 586-8723

Tel. no.

(206) 753-5770

AT&T

4460 Rosewood' Drive, Room 6330

Pleasanton, CA 94588

Attention: Patricia Mait~and

Facsimile no.: (510) 224-5498

Tel. no.

(510) 224-4926

, The name, address or facsimile number for notice may be changed by

giving notice in accordance with this section.

If mailed in

accordance with this Section, notice shall be deemed given when

actually received by the individual addressee or designat~d agent

or three (3) business days after mail,ing, whichever is earlier. If

transmitted by facsimile in accordance with this Section, notice

shall be deemed given when actually received by the individual

addressee or designated agent or one (1) business day after

transmission, whichever is earlier.

'

B.

Courtesy copies of any notices provided by one party to

the other under this Agreement shall be prov~ded, using any of the

.methods specified in Section 19A, to:

'

u.s. West Communications, Inc.

,14808 BE 16th, Basement

Bellevue, WA 98007 ,

,

Attention: Susan Haynes

Facsimile no.

(206) 451-6011

Tel. no.

(206) 451-532?

GTE Northwest Incorporated

2312D West Casino Road

Everett, WA 98204

Attention: Joanna Sissons

Facsimile no.: (206) 353-6558

Tel. no.

(206) .356-4175

PTI Communications

Post Office Box 90

Forks, WA98331

Attention: John Fryling

Facsimile no.: (206) 374-9636

Tel. no.:

(206) 374-2300

- 9 -

00031-6'

._-_.-

----

-

----------

_. __ . _ '

�20.

Rights in Data

The data covered by General Term IIRights in Data" contained in

Attachment B to the RFP does not include information relating to

interLATA, intraLATA or local calls, which shall remain the

property of the applicable carrier (AT&T, USWC, PTI or GTE), and

shall be kept confidential subject to the requirements of

Washington public recor9-s. law.

In the event of a third party

request for such data, the Department shall notify Contractor in

advance of responding to the request in sufficient time to allow

Contractor to negotiate any appropriate protective arrangements,

consistent with any applicable time limits for the Department to

respond to the third party, but in any event prior to disclosing

the data.

21..

Bond

Contractor shall post a performance bond or a performance/p~yment'

bond in the amount of $500 1000 on a form acceptable tc5-· the

Department.

Such bond shall be for the purpose of guaranteeing

satisfactory performance by Contractor of the services required

hereunder and the payment of commissions due or owing to the

Department.

22. 'Incorporation of General Terms and, Conditions

The Department of Corrections General Terms and conditions, as

set forth in Attachment B to the RFP, are incorporated herein by

reference, except as modified are amended herein, and with the

exception of the following, which are deleted as inapplicable to

this project:

A. General Term "Indemnification" on' page 5 of Appendix B is

super'seded by section 13 above ("Indemnification").

B. General Term "Disputes II on page 10 of Appendix . B is

superseded by section 17 above ('rConflict Resolution"), and section

18 ("Termination and Termination Procedure ll ) .

C. General Terms "Termination by Contractor" and "Termination

for Convenience on page 11 of Appendi~ B are superseded by section

,5 .above (IITerm") and section 18 (UTermination and Termination

Procedure U).

23.

Contract Modifications

The parties may supplement or amend this Agreement by mutual

consent, provided such supplement or amendment is in writing and

signed by authorized representatives of both parties.

-:' 10 -

1-- --------- ----------- -

O,inn

uV·31'" ~7

�~-

..... :

.'

'.

, ,

24.

Entire Agreement

-'

This Agreement and the documents incorporated herein by

reference, Le., the Combined Proposal, the RFP and the Department

of Corrections General Terms and Conditions (Atta9hment B),

constitute the entire understanding between the parties and

supersede

all

prior

understandings,

oral

or

written

representations,

statements"

negotiations,

proposals

and

undertakings with respect to the subject matter hereor.

In the

event that any provisions of this Agreement and the incorporated

documents are inconsistent, the order of precedence shall be as

follows: (1) this'Agreement; (2) the Combined Proposal (except for

USWC J S response to Attachment B to the RFP; (3) the RF:? and (4) the

Department of Corrections General Terms and Conditions (Attachment

B) •

.

STATE OF

DEPARTME

.~..w-~~PHONE

PANY

&,

.

TELEGRAPH

J::

By:

By:

(Signature)

Joh)\ ?ow.tll

Chase Riveland .

(Typed or Printed Name)

(Typed or Printed Name)

~Le.~

Ti

Secretary

(Title)

V, 1>.

=ZJ12.(Da~

(

3/31/92

. (Date)

.

Approved as to Form:

OFFICE OF THE ATTORNEY GENERAL

STATE OF WASHINGTON

(Typ~d

or Printed Name)

A~}~{~~ ~

A~~rll<e.J

Gevl.(?r\ \

(Title)

.- 11 -

000318

�,•.'; .• 0'• . r,.

... .~

"

..

... "

.....

~

COMMISSION SCHEDULE

AT&T: commission rate of 24% on billed revenues from operatorassisted intraLATA, interLATA and international calls carried by

AT&T.

1.

2. GTE: commission rate of 27% on billed revenues from operatorassisted local and intraLATAcalls carried by GTE.

3. PTI: commission rate of 27% on billed revenues from operatorassisted local calls carried by PTI.

4. USWC: the following commission rates shall apply to billed

revenues from. operator-assisted local and intraLATA calls carried

by USWC:

USWC agrees to pay the Department a commission rate of 35%. At the

end of each calendar year· cif this Agreement I USWC shall review

billed USWC revenues against the schedule shown below and increase

the compensation, if appropriate, as follows:

Adjustment Level &

New Commission Rate

Annual USWC Revenue

$2.0 Million

$3.0 Million

$4.0 Million

35%

36%

37%

The USWC commission rate will not fall below 35%. Once a level of

commission has been achieved, ·it will remain in place throughout

the remaining years of this Agreement unless the next appropriate

level is attained.

ATTACHMENT· 1

-_._--_.-._----~-_._--'._----------

-

--

---

---

--

-

- --

---,~~~

~-~-~-

�STATE OF WASHINGTON .

DEPARTMENT OF CORRECTIONS

REQUEST FOR PROPOSAL NO. CRFP2562

INMATE TELEPHONE SYSTEM

AND

RECORDING/MONITORING

ISSUA~CE DATE: SEPTEMBER 4,1991

000320

�TABLE OF CONTENTS

SECTION 1-1 GENERAL INFORMATION

A.

Definitions . . . . . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. i

'B.

Purpose. . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . .'. . . . . . . .. 1

C.

. Background .,......................................... 2

SECTION 1-2 SCOPE AND OBJECTIVES .. ," .. ',' . . . . . . . . . • . . . . . . . . . . . .. 2

A.

Scope. ,

B. '

Objective

,.'

','

,

'. 2

:'

, .. '.'

'

, . . .. 2

SECTION 1-3 PROJECT REQUIREMENTS

'. ;.. 3

SECTION 1-4 PERFORMANCE PERIOD . . . . .. . . . . . . . . . . . .. .. . . . . . . . . .. 4

~

SECTION 1-5 GENERAL INFORMATION

, 4

, SECTION 1-6 RFP MODIFICATION

SECTIONn

" . . . . . . . . . .. 4

PROPOSAL INSTRUCTIONS ','

;

; . .. 5

SECTION 11-1 ISSUING OFFICE' .•....•...•..................... '. . . .. 5

SECTION 11-2 PRE-BID CONFERENCE

'

'. .. . . . . . .. 5

SECTION 11-3 PREPARATION COSTS

5

~ . . . . . .6

SECTION 11-4 BIDDER AND PROPOSAL REQUIREMENTS,

A. "

Eligibility. '

','

B.·

Qualification Requirements .;

','

'

,

';

'. . .. 6

,

6

SECTION 11-5 PROPOSAL FORMAT AND CONTENT REQUIREMENTS . . . . . . .. 6

A.

'Proposal Format and Centent .. ,

:'

;. 6

1. Technical Proposals . . . . . . . . . . . . . . . • . . . . . . . . .. . . . . . . .. 6

2. Management Proposals

, .•....... ' 7

i

000321

�3. 'Cost Proposals

'

','

_

"

7

SECTION 11-6 PROPOSAL VALIDATION PERIOD .•...................... 7

SECTION 11-7 EVALlJATION PROCEDURE . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 8

,SECTION 11-8 SCHEDULE OF ACTIVITIES AND DEADLINES

A. Schedule of Activities

'. . . . . . . .. 9

'. . . . . . . . . . . . . . . . . . . . .. 9

B: Bidder's Proposal

'.'

'. . . . . . .. 10

" . .. 11

SECTION 11-9 REJECTION OF PROPOSALS

SECTION 11-10 ADDENDUM/MODIFICATIONS ..........•............. '.-:

11

SECTION 11-11 EQUAL OPPORTUNITY ASSURANCES .... : ...,. . . • . . . . . .. 12

SECTldN 11-12 ESCAPE CLAUSE . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . .. 12

.

.

SECTION 11-13 MINIMUM ACCEPTANCE 810 PERFORMANCE LEVELS

12

SECTION 11-14 NOTICE OF AWARD OF CONTRACT ...•............ ~

13

SECTION 11-15 MISCELLANEOUS PROVISIONS

: . . . . . . . . . .. .. 13

SECTION 11-16 DEBRIEFING OF UNSUCCESSFUL VENDORS

13

SECTION 11-17 GENERAL TERMS AND CONDITIONS. . . . • . . . . . . . . . . . . . .. 15

APPENDIX A •.•...........•...... TECHNICAL SPECIFICATIONS SECTION

APPENDIX 8

'. . . . . . .. MANAGEMENT PROPOSAL REQUIREMENTS

APPENDIX C ........................•....•........ ,SPECIFICATIONS,

MULTI-CHANNEL COMMUNICATIONS RECOBDING SYSTEM

ATTACHMENT A(1)

ATTACHMENT A(2)

:

-'

:

CORRECTIONS CENTERS

'. MONITORING/RECORDING EQUIPMENT

ATTACHMENT A(3) ...............• WORKITRAINING RELEASE FACILITIES

ATTACHMENT B

GENERAL TERMS AND CONDITIONS

ATTACHMENT C

EQUAL OPPORTUNITY ASSURANCES

ii

000322 .

�REQUEST FOR PROPOSAL

NO. CRFP2562

STATE OF WASHINGTON

DEPARTMENT OF CORRECTIONS

INMATErrELEPHONE SYSTEM

1-1

GENERAL INFORMATION REGARDING PROJECT

A.

Definitions for the Purpose of this RFP

1.

Bidder-Person or company submitting a proposal in order tc..attain

a contract with the Department.

2.

Contractor-Person or company whose proposal has been accepted

by the Department and is awarded a formal written contract.

3.

B.

. Department- The Department of Corrections, Division of Prisons.

4.

DOC;. The State of Washing!on, Department 01 Corrections.

5.

Correctional Facilities- Correctional Institutions and Work Release

.facilities within the jurisdiction of the Department of Corrections.

6.

OCR- Office of Contracts and Regulatk;ms.

Purpose

The State of Washington Department of Corrections, hereinafter referred to

as "Department", is seeking a qualified revenue producing Operator

Assisted Telephone Service, to handle the inmate telephone services for

Correctional Institutions and 'Work Release Facilities listed on attachment

A, attached and incorporated as part of this proposal. Inmate telephone

services are currently being provided within all jurisdictions of the

Department It is the Department's goal to collect the information necessary

for the evaluation of competitive proposals submitted by. qualified bidders, .

which will eventually result in a contract' between the successful bidder and

the DOC. This request for proposal is intended to provide qualified bidders

with information which will permit them to respond to the DOC With a bid to

provide inmate telephone service, wiring, and all associated equipment at

all locations listed in attachment A plus inmate monitoring, recording

-- - - - - - _ . -

---

-- - - - - - - -

-

-

---

- --

--

-

-- --

--

-

--

-- -

-

�hardware/software and associated equipmentat all medium and maximum

institutions listed on attachment A.

C.

Background

WAC 137-48-080 states that telephone facilities shall be provided in

appropriate numbers and locations to permit reasonable an:d equitable

access to all inmates, except those of the reception center and disciplinary

segregation. Following the intent of the WAC, the DOC in 1980, provided

phone access to all offenders in community residential facilities and

correctional institutions. Each facility has traditionally been allowed to

determine its own guidelines for telephone availability, maximum length of

calls, 'and limitations of inmate phone use sUbject to the approval of the

Secretary.

1-2

SCOPE AND OBJECTIVES

A.,

Scope

The inmate telephone service, as defined in this document,shall include all

inmate phone service, including intraLATA and interLATA, international'

calls, long distance and local calls. The inmate telephone system will

handle operator assisted calls only, that are billed to a location other than

the originating station. The telephone service will also provide attorney

phones. It will also have the ability t6 block from usage any number or

series of numbers requested by DOC; Le.., 800, 900, 976, areas, 555 and

intemational directory assistance calls. Any requests for calls other than'

collect shall be refused. Contractor have the ability to provide problem

resolution of inmate phone service ~ithouf any utilization of DOC staff.

B.

Objective

A successful proposal shall include an evaluation which shall address the

following factors: '

.

- Provide a recording/monitoring system of inmate telephones at no cost to

the agency.

- The ability to provide problem resolution of inmate service without any

''

,

'

utilization of DOC. staff.

- The ability to block from usage any number or series of numbers

requested by DOC.

2

O,d)1./ (\l) 3.2/-j1

�- Provide intraLATA. interLATA, international, long distance and local calls.

- Assumption of full financial responsibility for any costs associated with

charges related to fraudulent credit use, incorrect, non-working or nonexistent telephone numbers used for collect calls or any- fraudulent act.

- Provide telephone sets, lines, wiring, calling, enclosures, associated

equipment at no cost to agency.

-Provide moqthly usage and financial statements to include telephone .

numbers called from each inmate telephone, at no charge to DOC within 30

days of the previous month.

:Pr6vide attorney phones to operate without monitoring/recording capability.

Telephones must be located where staff members can view inmates making

calls. Cut off keys must be provided so staff. can activate phones.

-Provide information to DOC facilities:.Le.. name, social security number,'

date of birth, and photo Ld. prior to entry of any DOC facility. ,Contractors

must make the appropriate arrangements with each institution work training'

release facility to provide this information.

,

-Ability to provide additional telephone service to new facility locations as

needed.

.- Provide phone service which is compatible with 'telephone monitoring

/recording equipment (Dictaphone/Call Watch).

-Contractor shall also maintain sufficient records showing date, time and

, 'nature of services rendered to permit verification by the DOC. These

records shall be subject to inspection by DOC and the State Auditor. DOC

shall have the right to audit Pre-Subscription Commissions both before and

after payment by Contractor. Payment under this Agreement shall not

foreclose the right of DOC to recover illegal payments by Contractor.

- Provide the service, etc...with rates no higher than the standard of U.S.

West and AT&T with a commission to the Inmate Welfare Fund of each

institutionlWork Training Release facility.

1-3

PROJECT REQUIREMENTS

Within the scope and objectives described, the successful Contractor must also

demonstrate the following: .

. '

3

() (1 n ') 'f) ~

,l IVU'-'4J

�.. A detailed description' of the overall project, equipment (phone monitor

Irecording), and management plan in narrative form.

- The completed technical and management proposals.

- For circumstances where proposer cannot comply with individual DOC request,

a written list of exceptions and reasons why compliance is not possible. The

explanation of exceptions should be supplied on the technical and management

proposal checklist Which is supplied within the RFP.

- The proposal must"include a definition of applicable terms and how they will be

used within the proposal. Specific examples must be included of the terms used

in specific c!rcumstances.

. 1-4

PERFORMANCE PERIOD

The period of performance of any contract resulting .from this RFP is tentatively

scheduled to run five (5) years and begin on or about November 5, 1991 and be

in force through June 30, 1996.

Amendments extending the period of

. performance, shall be at the sale discretion of the Department. Any additions,

regardless of date, during the term of this Contract, shall expire on the same date

as the expiration or termination date of the contract.

'

1-5

GENERAL INFORMATION

The Contractor shall be provided with a list of Department officials who shall be

responsible for implementation of the resultant contract, both at the Institutions and

with the Department.

1-6

RFP MODIFICATIONS

.

The Department reserves the right to modify this RFP at any time. In the event

it becomes necessary to TDodify or revise any part of this RFP, addenda will be

provided to all bidders who receive the basic RFP.

,

4

000326

�j

SECTION /I

PROPOSAL INSTRUCTIONS

11-1

ISSUING OFFICE

The issuance of this RFP has been approved by the Secretary of the Department

of Corrections. The RFP Coordinator is the sole point of contact in the state for

this selection action. Throughout the duration of this process, all requests for

copies of the RFP and communications are to be directed to the RFP Coordinator:

.Kay Wilson-Kirby, Assistant Administrator/Operations

Office of Contract and Regulations

410 W. 5th

P.O. Box 9699; FN-61

Olympia Wa. 98504

Phone: (206) 753-5770 .

Communications directed to parties other than the. RFP Coordinator may result in

. disqualification of the. bidder.

11-2

PRE-BID CONFERENCE

A Pre-Bid Conference will be held at 10:00 AM, September 11,1991, for potential

bidders at DOC Headquarters, CENTER ANNEX CONFERENCE ROOM, 417

West 4th Avenue, Olympia Washington 98504. The purpose of this conference

is to allow potential bidders to ask questions arising from the review of this RFP.

Attendance at this pre-bid conference is not mandatory for acceptance of bid. .

DOC is strongly recommending all prospective vendors who do attend, to .bring a

technically orientated person with them for this pre-bid conference.

Any changes and/or clarifications to this RFP as a result of the pre-proposal

conference shall be made in writing and distributed to those ~ttending this

Oral

conference, as well as those who did not attend this conference;

interpretations shall not be binding on the department. Because of the schedule

of events outlined above, questions cannot be accepted or answered after the

proposal conference.

11-3

PREPARATION COSTS

The Department shall not be .liable for any costs asSociated with the preparation

5

•

�of a propqsal submitted in response to the RFP.

11-4

BIDDER AND PROPOSAL REQUIREMENTS

A.

Eligibilny

Bidders must be able to provide either intraLATA service and

recording/monitoring equipment or interLATA including international calls,

to be eligible to bid.

B.

Qualification Requirements

The successful bidder must possess the following minimum qualifications:

1. Be licensed to do business in the state of Washington, if requi~~~ by

state law and meet Utilities and Transportation and FCC requirements.

Bidders who do not meet these minimum qualifications shall be deemed

nonresponsive and will not receive further consideration.

11-5

PROPOSAL -FORMAT AND CONTENT REQUIREMENTS

A.

Proposal Format and Content

There ~hall be two sets.of proposals submitted. One set will include phone

service information; the second set will include phone monitoring/recording

information. The Phone Monitoring/Recording proposals must be separately

submitted and cannot be included within the Telephone Service Proposal.

Proposals must b~ prepared on 8 1/2" x 11" white paper (11" x 14" paper

is permissible for. charts, spread sheets, etc.) and all typing must be

doublespaced, with one inch margins on the sides, and placed in binders

with tabs separating the major sections. Each proposal is to be in sufficient

detail to permit evaluation. Proposals must be submitted in the format

outlined and must contain, at a minimum, all items listed in the sequence

shown below.

1.

Technical Proposals:

Define all work requirements necessary to accomplish the objectives

and requirements as set forth in Subsection 1·2 and 1-3, and the'

6

�information called for in Subsection 11-5 of the RFP. (See Appendix

A.) .

.

TECHNICAL PROPOSAL

RFP NO. CRFP-----

2.

Management Proposals:

.

.

The management proposals must contain the information called for

in Subsection 11-5 of this RFP. (see Appendix 8.) Submit five (5)

copies. Place the five (5) copies of the managemen~ proposal in a

. plain, sealed envelope marked on the outside:

MANAGEMENT PROPOSAL-----RFP NO CRFP---~---

3.

.Cost Proposals:

The cost proposals must include a budget that complies with the

requirements set forth in subsection 11-9 of the RFP. Submit five (5).

copies. Do not identify the respondent in any way in the proposal or

on the envelope. Place the five (5) copies of the cost proposal in a

plain, sealed envelope marked on the outside:

COST PROPOSAL------RFP NO. CRFP-------

11-6

PROPOSAL VALIDATION PERIOD

.

.

The bidder must agree, in writing, that proposals are valid for 90 days after

receipt by the Department. . The rates and percentages quoted must be

valid for 90 days and a second set of figures provided that shall be valid for

one year after the receipt of the proposal. Ttie validity period associated

with the sets of figures must be clearly written in the proposal. If the

proposal is vague or does not specify the period of time for which c9st

. estimates are valid, jf may be considered nonresponsive to this section and

the proposal may be rejeCted.

7

000329

-

-------~---------

------_._~------

--

-~

-- - -

---

----

--

~

-----

�11-7

EVALUATION PROCEDURE

The evaluation of proposals for each contract will be accomplished by a

committee that will determine which proposals are most responsible and

cost effective. The top three firms may, at the committee's discretion, be

required to make a presentation of their proposal to the evaluation

committee at the DOC Headquarters in Olympia, Washington, on or about . October 15,1991. A recommendation will be made by the committee to the

Secretary. The Secretary will make the final awards after review of the

recommendation of the committee. The DOC will evaluate the ability of the

contractor to provide inmate phone service and monitoring/recording

equipment, consistent with the needs of the institutional facilities. DOC will

also evaluate the Contractor's ability to increase telephone service for

additional and future correctional facilities, which may be on line within the

next few years. Other vital components of the DOC's evaluation will consist

of the following:

- The proposed price levels (amount to be bllied the customer) and

percentage of monetary remuneration returned to the State tor both

telephone monies as well as an access fee (cable) to inmate

telephones.

.

- The jUdgment of DOC officials relative to not only the ability, but

,the sincerity and willingness of the Contractor to provide inmate

telephone services and monitoring recording/equipment to DOC both

for facilities currently in operation and any new facilities which may

be built in the future.

- Evaluation of proposer's responses to mandatory requirements of

the RFP. The evaluation will include completeness of responses,

neatness, ease of locating material and/orfinding information, quality

of information and short concise responses made in such a way that

they are easily understood by a lay person.

~

DOC's belief of contractor's ability to increase services provided for

in contract, to ariy new correctional facilities which may be built in the

future.

In evaluating each proposal, the committee will consider the Jollowing:

:. How well the proposal meets the program objectives of this RFP.

~

Information submitted in response to the RFP.

8

�- The proposer's technical approach (repair, equipment and service

information). (See Appenqix A.)

• The qualifications and background of proposers staff to be

assigned to the institutions. (See Appendix B)

- The proposer's previous and successful experience in representing

. institutionalized persons and/or criminal defendants. (See appendix

B.)

• Other questions. relating to the proposers organization. (See

Appendix A)

,

• Compatibility of Telephone Monitoring/Recording equipment with

Telephone Service System.' Telephone Monitoring/Recor-dinq

System must be Dictaphone/Call Watch.

- Participation by minority and women's business enterprises certified

by th'e Office of Minority and Women's Business Enterprises.

- Questions relating to a competitive commission without denigrating

the level of service. (See Appendix A.)

Scores awarded the proposals will be utilized for determining those firms asked to

make a brief personal presentation for their proposals. Final recommendation shall .

be made by the commit:tee considering both the oral presentation and the written

proposal. ,The DOC reserves the right to. contact proposers for clarification of

definitions, terms and other information which is not easily understandable. The

DOC reserves the right to award this contract not necessarily to the bidder

providing the highest commission to DOC, but to the bidder that demonstrates the

. best ability to fulfill the requirements of this RFP, after considering the factors of

price, quality, service, responsiveness and expertise.

.

11-8

SCHEDULE OF ACTIVITIES AND DEADLINES

A

Schedule of Activities

The following schedule of activities must be adhered to by all bidders.

Bidders mailing proposals should allow normal mail delivery time to ensure

timely receipt of their proposals by the issuing office (RFP Coordinator).

LATE PROPOSALS WILL NOT BE ACCEPTED, NOR WILL TIME

EXTENSIONS B.E GRANTED.

9

000331

�~

B.

1.

RFP available to Potential Bidders

September 4, 1991

2.

Pre-Bid Conference.

September 11, 1991

3.

Deadline for Receipt of Pr9posals

October 9, "1991

4.

RFP Evaluation Date

October 10,11 J 1991

5.

Oral Presentations

October 15, 1991

6.

Notification of successful bidder

October 16, 1991

7.

Contract begins

November 5, 1991

" Bidder's Proposal

Five (5) copies of each proposal and five (5) copies of all supporting

documentation, whether mailed or hand delivered, must be received at the

RFP Coordinator's Office· no later than 5:00 pm Pacific Daylight time,

October 9, 1991. The proposals shall be addressed as follows:

Kay Wilson-Kirby

Office of Contracts and Regulations

Department of Corrections

410 W. 5th Avenue

P.O. Box 9699; FN-61

Olympia, Washington 98504

Proposals must be signed by a dUly authorized officer'of the bidder's firm.

No other diStribution of the proposal is to be made by the bidder.. All

proposals and accompanying documentation become the property of the

Department and will not be returned unless identified as "proprietary

information". DOC shall. have the right to use any or all ideas or

adaptations of the ideas presented in any proposal received in response to

this RFP. Selection or rejection of the proposal will not affect this right.

Any restriction on the use of data contained within a proposal must be

clearly stated in the proposal itself. Proprietary information submitted in

response to this RFP will be handled in accordance with applicable

Washington DOC Regulations.

The content of the proposal of the successful bidder will be included by

reference in any resulting contract,

.

10

n.nQ·3"

O'UUv

2"

�The proposals must be signed by a person(s) authorized to legally bind the

bidder.

The proposer will be' required tb post a" performance bond or a

periormance/payment bond in an amount and on a form acceptable to the

DOC which will be negotiated by DOC. Such bond shall be for the purpose

of guaranteeing ,satisfactory performance of services required hereunder

and the payment of commissions due or owing the DOC.

11-9

REJECTION OF PROPOSALS

DOC reselVes the right to reject any and all proposals received, in whole and in

part. DOC will not pay for any information herein requested, nor is it liable for any

costs incurred by the bidder in the preparation or response to this RFP. The final

selection, if any, will be that proposal which, in the opinion of the Secretary, after

review of all the evaluations and recommendations of the evaluation committee,

best meets the requirements set forth in the RFP and is in the best interest of the

DOC.

Proposals providing less than 60 days tor acceptance by the DOC from the date

set for the receipt of proposals will be considered non-responsive and will be

rejected. Proposals that do not address all areas reqOuested by this~FP may be

deemed non-responsive and may not be considered for any possible contract

awarded as a result of this RFP.

Should DOC and the proposer selected be unable to negotiate a satisfactory

contract, the proposer's proposal will be rejected and DOC will enter into

negotiations with the proposer submitting the next best proposal~ as ranked by the

evaluation committee and the Secretary.

11-10

ADDENDUM/MODIFICATIONS

Any interpretation, co~rection or change of the RFP Will be made by addendum:

o

Interpretations, corrections or changes of the RFP made in any other manner will

not be binding, and bidders shall not rely upon such interpretations, corrections or

changes. Any changes or corrections will be issued by the DOC Contracts Office.

Addenda will be mailed or delivered to all who are known to have received an RFP

and who have attended the pre-bid conference. No addenda will be issued later

than ten (10) days prior to the date for receipt of bids except an addenda, if

necessary, extending the date for receipt ofobids or withdrawing the RFP.

In the event it becomes. necessary to revise any part of the RFP, addenda will be

provided to all persons who receive the RFP. If any proposer ohas reason to doubt

°

°

11

_0__ -

0

_

_

_

0

0

-0----0---- - -

~-_

�whether DOC is aware of the proposers interest, it is incumbent on the proposer

to notify DOC to ensure that addenda are received. Mail or call such notice to:

. Department of Corrections

Office of Contracts and Regulations

ATIN: Kay Wilson-Kirby

410 West 5th

P.O. Box 9699

Olympia Wa. 98504

RFP Number: CRFP2562

Phone Number:

11-11

(206) 753-5770

EQUAL OPPORTUNITY ASSURANCES

RESPONDENTS REQUIRED ,BY STATE OR FEDERAL LAW TO HAVE

AFFIRMATIVE ACTION PLANS MUST BE PREPARED TO PROVIDE TO DOC,

UPON REQUEST, COPIES OF THEIR CURRENT AFFIRMATIVE ACTION PLAN

AND RECENT EVALUATION OF THAT PLAN. RESPONDENTS NOT REQUIRED

BY LAW TO MAINTAIN AN AFFIRMATIVE ACTION PLAN MUST COMPLETE

AITACHMENT "C" TO THIS RFP AND RETURN IT WITH THE PROPOSAL.

11-12

ESCAPE CLAUSE

DOC reserves the right to waive specific terms and conditions contained in this

RFP or cancel th.e RFP altogether if conditions necessitate such an action. It shall '

be understood by the proposer that the proposal is predicated upon acceptance

of all terms and conditions contained in this RFP unless the respondent has

obtained such waiv~r in writing from DOC prior to submission of the proposal.

Such a waiver, if granted, will be applicable to all proposers.

11-13

MINIMUM ACCEPTANCE BID PERFORMANCE LEVELS

'\

Requirements, as set forth in this RFP, are meant to indicate only the minimum

acceptable levels of performance.

12

--~-~-----~-------------

---

-

--

-----

----------------~- - - - -

�Proposers should present their proposal in such form as"to meet or exceed the

minimums stated. The evaluation committee will consider proposals as they relate

to providing the best telephone service - monitoring/recording equipment for the

facilities.

.

Proposers should present a proposal which will indicate how services will be

provided, monitored and evaluated. Proposals setting forth clear, c.oncise and

quantifiable/measurable programs will be received more favorably than those which

do not.

11-14 NOTICE OF AWARD OF CONTRACT

DOC will endeavor to notify all proposers on or about October 16, 1991, which

proposers DOC has selected to negotiate contracts.

11-15

MISCELLANEOUS PROVISIONS

.

11-16

,

A. •

Authority to Bind DOC: The Secretary is the only individual who may legally

commit DOC to the expenditures of public funds. No cost chargeable to the

proposed contract may be incurred before receipt of either a fully executed

.

contract or a specific, written authorization from the Secretary.

B.

Attachment B: The "Equal Opportunity Assurances" form must be signed by

the President or Executive Director of a corporation, the managing partner

of a partnership, or the proprietor of a sale proprietorship .and returned with

the proposal.

C.

Signature: All proposals must be signed and dated by the President or

Executive Director of a corporation, the managing partner of a partnership,

or the ,prC?pri~tor of a sole proprietorship.

.

DEBRIEFING OF UNSUCCESSFUL VENDORS

A.

Bidders protesting this award shall follow the procedures described herein.

Protests that do not follow these procedures shall not be considered. This

protest procedure constitutes the sale administrative remedy available to

bidder under this procurement.

.

.

. -Upon exhaustion of this remedy, no additional recourse is available within .

the Department. Chapter 34.04 RCW, Administrative Procedures Act (APA)

does not apply to this procurement.

.

13

000335

�B.

Upon receipt of a protest. a protest review will be held by the Contracts

Office to review the procurement process utilized. This is not a review of

proposals subm'itted or the evaluation scores received. The review is to

ensure agency policy and procedures were followed, all requirements were

met and all bidder:s were treated equally and fairly.

C.

. Only protests setting out an issue of fact concerning a matter of bias,

discrimination or conflict of interest, errors in tabulation, or noncompliance

with procedures described in the procurement document or agency policy

shall be considered.

0:

All protests must be in writing and signed by the protesting party or an

authorized agent. Telegrams or·similartransmittals will not be considered.

The protest must state all facts and arguments on which the prot~sting

party is relying, and addressed as follows:

Contracts and Regulations Administrator

Office' of Contracts and Regulations

Department of 'Corrections

P.O. Box 9699

Olympia Wa 98504

If a protest may affect ttie interest of any bidder, such bidder(s) will be

given an opportunity to submit its view and any relevant informationori the

protest to the Contracts and Regulations Administrator.

E.

If the protest involves the rejection of a proposal, the -protest must be

received by the Contracts Office no laterthan 5:00 pm, on the fifth business

day following bidder's receipt of the notice of rejection, whether oral or

written, or the announcement of the apparent successful bidder, whichever

occurs first Only those who are eligible to submit a-proposal under the

criteria established by the OCR may protest the rejection of a proposal.

F.

OCR will consider the records and all facts available and issue a decision

within five business days of receipt of the protest unless additional time is

required, in which case the protesting party will be notified by the OCR of

the delay. The decision of the OCR will be final and conclusive.

14

�11-17

GENERAL TERMS AND CONDITIONS

The General Terms and Conditions attached to this RFP as Attachment "B" will be

incorporated in any contract awarded pursuant to the RFP. The Definitions section

of such General Terms and Conditions shall apply to this RFP.

.

I

1-5

000.337

�APPENDIX

A

TECHNICAL SPECIFICATIONS SECTION

Each statement the company can comply with must be initialed by

the company representative authorized to·negotiate this contract.

For other responses requested, the answer must be given and

initialed.

If the company cannot comply with a statement, an

" exception" must be noted.

For each statement requiring

additional information, a separate sheet must be provided and

identified by the section, sub-section and number assigned.

A.

Service

1.

Can provide operator services

trained to DOC procedures

including but not limited to the

"operator announcement" as'mandated

by the Drug Omnibus Bill, Chapter

271, Laws of 1989.

2.

If·using computer generated operator

service, can provide rotary dial

collect calls within the same time

frames as touchtones.

3.

If using computer generated operator

service, can provide capability'for

called parties with rotary dial phones

to accept calls. Provide method on a

separate sheet and label technical *3.

4.

Can provide 'service with no

surcharge to called party or

DOC.

5.

Can provide a private line for

each telephone set.

6. - Can provide telephone sets, all

associated equipment, and lines at

all listed DOC locations.

7.

Can provide precise equipment clocks

(timing mechanisms). Attach

certificate of accuracy and

mark. technical #7~

Page 1 of 5

Yes

No

�Yes

8.

Can provide credit for a'bad

connection.

9.

Can provide a P.Ol grade of

service.

11.' Can provide "busy II or IIno

an Swe-r II condition at no charge.

12.

Can provide answer supervision.

13.

If using computer assisted

operator service, can provide

technology that can detect

messages, voice recorders

and hang up immediately.

14.

Can provide telephone sets, all

equipment., lines,. calling, recording

monitoring, hardware/software and'

associated equipment and local,

intraLATA services. If contracts

with other vendors, please provide

a copy of contract(s) and mark

'Technical #14 for evaluation

identification.

15.

Can provide interLATA and international

calling services. If contracts with

other. vendors, please provide copy of

contract(s) and.mark Technical #15 for

, evaluation identification.

16.

Can install public and inmate

telephones, associated equipment

wiring hardware and enclosures

at each listed institution/work

trainlng release facility.

17 .. Can provide monthly usage and

financial statements to include

telephone numbers called at no

charge to DOC. Attach examples'of

statements the company would

utilize. 'Provide information on

separate sheet and label technical

service #17.

18.

Can provide the monetary amount, if

any; of the minimum revenue threshold

for each phone location. Provide

Page 2 of 5

No

�Yes

No

information on separate sheet and

label technical service #18.

:9.

Can provide proposal of plans to

interface with the local operating

companies , i . e ., Public Access, Lines

(PAL), access charges. Provide

copies of proposals and mark

Technical,#19.

20.

Can provide telephone instruments,

conduit, cabling, lines and

associated equipment, at each listed

facility. Can maintain a minimum ratiQ

of 1 telephone and'line for 20 inmates.

Ideal ratio is one telephone per 15 inmates

except as required by DOC for security

i.e.~. a lower ratio for hospital high

security are'aswithin institutions.

21.

Can capture and account for all

local, intraLATA and interLATA

and international calls ..

22.

Can provide rate schedule for

collect calls. Attach schedule

and mark Techriical #22.

23.

State whet·her or not your rates are more/less expensive

than:

ATT

more

less

percentage.

'%

Mer

more

less

percentage

~

0

SPRIN':'

more

less

percentage

%

US

more

less

percentage

.% .

-more

le~s

percentage

%

WE~'"

~-

Others

,Provide rate schedule, marked Technical #23.

Z~.

Can provide operator center

equipment ind~cating calls

are from prison inmates.

00034f)

Page 3 of 5

�No

Yes

25.

Can provide direct payments

by way of monthly checks

to each facility.

26.

Can comply with the

requirement to block telephone

numbers that inmates are not

allowed t~ call and provide a

method to get back to inmates

for problem resolution. Provide

information on method on separate.

sheet and label Technical #26.

27.

State the time frame required to

add, change or cancel a blocked

number. Provide information on

separate sheet and label technical

#27.

28.

Can comply with the requirement

for system redundancy.

29.

Must comply with the requirement

for disaster-recovery plan. Attach

copy of plan and label Technical,

#29. Certify that you have

- a disaster recovery plan.

30.

State the compensation rate and

type; i.e., net, billed revenue, etc.·

Attach an explanation of definitions

for the terminologies and example~

used in the proposal; and, label

Technical #30 for evaluation identification (separate sheet) .

31,

State the fee for an operator assisted

local call and indicate whether it is a

flat fee or per minute cparge. Provide

on separate sheet and label

technical #31. -

32.

State the number of calls that

can be handled simultaneously.

33.

State the time increment charges

(separate sheet and label

technical #33.)

\

000-341

Page . of 5

- - - - - - - - - - - - - --------

._--~

-

-----

-

--~--------

-

-

--

---

-

-

-

�Yes

34.

Can provide call,forwarding

blocking?

35 .. Can provide call length

delineators?

Reoairs

36.

Provide location, telephone

numbers and number of installers,

and repair persons that would be

serving the Department of Corrections

State of Washington facilities at

each institution/work training release _.

facility of the Department

Attach a list and'mark Technical,

Repairs #36.

37.

Cari provide information on how

repair problems are detected and

reported. Attach information and

label Technical, Repairs #37.

38.

State the response time for repairs

from time reported to technician to

technicians arriving on site. Attach

information and label Technical Repairs'

4/:38.

39.

Can service and repair all inmate, public

telephones, and associate~ equipment

monitoring/recording, hardware/software

and associated equipment at contractor's

expense.

Eauinme!1t

.....

4"

-

Can comply with requirement for

equipment for the hearingirnpaired

meeting Federal and State Law

standards.

4:.

Can comply with the requirement

of equipment registration with

FCC. Attach a copy of proposed

equipment FCC numbers and label

:Technical, Equipmell1:#41.

Page 5 : f 5 .

No

�Yes

42.

Can provide brochures, warranties,

information pertaining to equipment

to be provided for inmate/pay phone

services. Organize and label

Technical, Equipment #42 for

evaluatio~ identification.

.

43.

Can provide cut off keys for each

inmate telephone set, to be located

at each institution as directed by

'No

DOC.

44.

Can remove phones on a temporary

basis for building expansion or

renovation and reinstall. at no

cost to the agency.

~5.

Provide copy of written operational

procedures to be posted at or

near inmate phones on date of· cut over

and label technical Equipment #45.

~6.

Can provide emergency maintenance,

on site response time within three

(3) hours for 95% of all emergency

maintenance calls 24 hours a

day, seven (7) days a week.

~7

. . Can provide routine maintenance

on-site response time within

twenty-four (24) hours after

receipt of a routine maintenance

call and 'perform during normal

business hours 8:00am - 4:30pm

Monday through Friday.

';8.

~9.

Can provide an on-site status

report to the designated on-site

coordinator and maintain daily

detailed trouble log for Dept.

perusal.

Provide a description of

-maintenance organization capable

of maintaining'the installed

equipment and software on

seoaratesheet and label technical

eqUipment #49.

Page - of 5

1----- ---- .-- -~-~---- -

000343

�Yes

50.

No

Can provide telephone sets of

high quality, with amplifiers

when required and noise

cancellation devices.

Instal:ation/lmplementing Schedule

. Provide an implementation plan

and installation schedule for

all services, equipment being

proposed. Separate sheet and

label technical *51.

000344

?age 7 -- 5

"-

---~_.

-

--

.~

.. _ - - - - -

..

--_._-~_

_--------_._-_._-~-

-_._-----_._-----_._-~---

-----------------

.

._------~---

---------------------------------._- - - - -

~

--

-------------------~--~-------_._._._--

------

-------

�APPENDIX B

MANAGEMENT PROPOSAL REQUIREMENTS

A.

-~entifyina

2.

":.

- ..

B~

What is the name .of your company?

What is·tht:: address of your

company?

What is the telephone number for

your company?

What is the name of your company's

principal officer?

What is the name of your company's

project leader for inmate telecommunication service?' .

What is your company's Washington

business license r.uIti.ber and employer

identification nu~~er?

How many' telecommunications staff

does your company employ?

Where is your company headquarters

located?

;~~erience

L..

Information

of Proposer

What is the length of time that your

company has been in business in

telecommunications?

What is your company's previous

experience supplyi~g telecommunibations

service within the State of

"Washington?

If your company or any connecting

entity has previously contracted

with the DOC r please indicate the

contr~ct number and the period of

performance?

What clients has your company

serviced within the area of inmate

telephone services? List the

clients, contact person, telephones

?age 1 of 2

000345

�numbers and addresses. A minimum of'three

contacts must be provided for

references. Attach separate sheet

and lapel Management B.#4.

*

?lease supply, an organizational chart of your company to

~nclude the following information: Label management B.#5.

principal officers of your company.

key staff to be assigned or employed for inmate and pay

telecommunications services.

qualificatio~s of key operations personnel.

the authority of ?ersonnelinvolved in t0e performance

of this potential contract.

the relationship of this specific, staff to o"C.her

programs or functions in your company.

?ersonnel/Hirirta'

Will your company assign live operators

to the institutions? (If exceptions,

please explain on a separate sheet of

paper and label Management C. #1.

,Will your company assign operators

who are specially trained to handle

inma"C.e calls?

What type of calls will your operators

accept from inmates? For example:

--credit card calls

--3rd party' billed calls

--directory assistance calls

--collect calls

-::

.

'How may operators will be assianed

to handle institution calis? --1 to 2

--2 to 3'

--4 or more

Will your company ~ave installation

and maim:.enance personnE?l ~'I'it:t;l.in

?aqe'2 of 2

0003.46

�reasonable access to installation

sites?

Are your operators and staff familiar

with the requirement for call

recording and monitoring of

inmate calls for correctional

facilities?

*

C::ltractors must assure that they are able to comply with

~:. -;

relative state. and Federal regulations and insurance

~eauirements, as well as the ability to obtain any reauired

:"~enses or permits which may be necessary.

It shall rre the

~esponsibility of the CQntractor to ascertain if permits or

'~enses are reauired.

:age

a of

2

000347·,

�APPENDIX C

SPECIFICATIONS

MULTI-CHANNEL COMMUNICATIONp RECORDING SYSTEM

1.00 GENERAL

This specification covers logging tape recorder/reproducer systems

.designed to provide recording of 4 to 240 channels plus the

time/date signal mUltiplexed on one channel with' aUdio.

The

equipment furnished under this specification shall be designed for

continuous duty operation, i. e. 24 hours per day, 365 days per

year.

1. 01.

All equipment supplied under this specification shall be

completely operational when

installed.

After

the

equipment has been accepted and placed in service, the

vendor shall guarantee it for a period of one year. and

will replace, free of charge, any parts, thereof, which

become broken or defective, except by reason of accident,

'misuse, or any casualty, during such period.

1. 02

The vendor will make all necessary adjustments to this

,system, not required by reason of accident, misuse, or

any casualty, at the vendor1s expense for a period aE ~